Founders navigating today's fintech landscape face a critical decision: choose traditional fintech development services or embrace AI fintech builders that leverage artificial intelligence in finance. This choice shapes everything from your fintech app development timeline to your competitive positioning in an increasingly automated financial services market.

This guide is designed for fintech startup founders, CTOs, and business leaders who need to understand the fundamental differences between conventional development approaches and AI-powered financial services before making their next strategic move.

You're probably wondering whether your fintech needs traditional development or if AI fintech solutions are worth the investment. Maybe you're confused by terms like "machine learning fintech" or "intelligent fintech platforms" that keep showing up in vendor pitches.

We'll break down everything you need to know, including:

Understanding Traditional Fintech Development Services vs AI-Powered Solutions - The core differences in approach, capabilities, and when each makes sense for your business

Key AI Technologies Transforming Financial Services - From predictive analytics to generative AI, what's actually working in real fintech applications today

Strategic AI Implementation Framework for Fintech Founders - A practical roadmap for deciding where and how to integrate AI into your fintech technology stack

Skip the confusion and get the clarity you need to make smart decisions about your fintech's technical future.

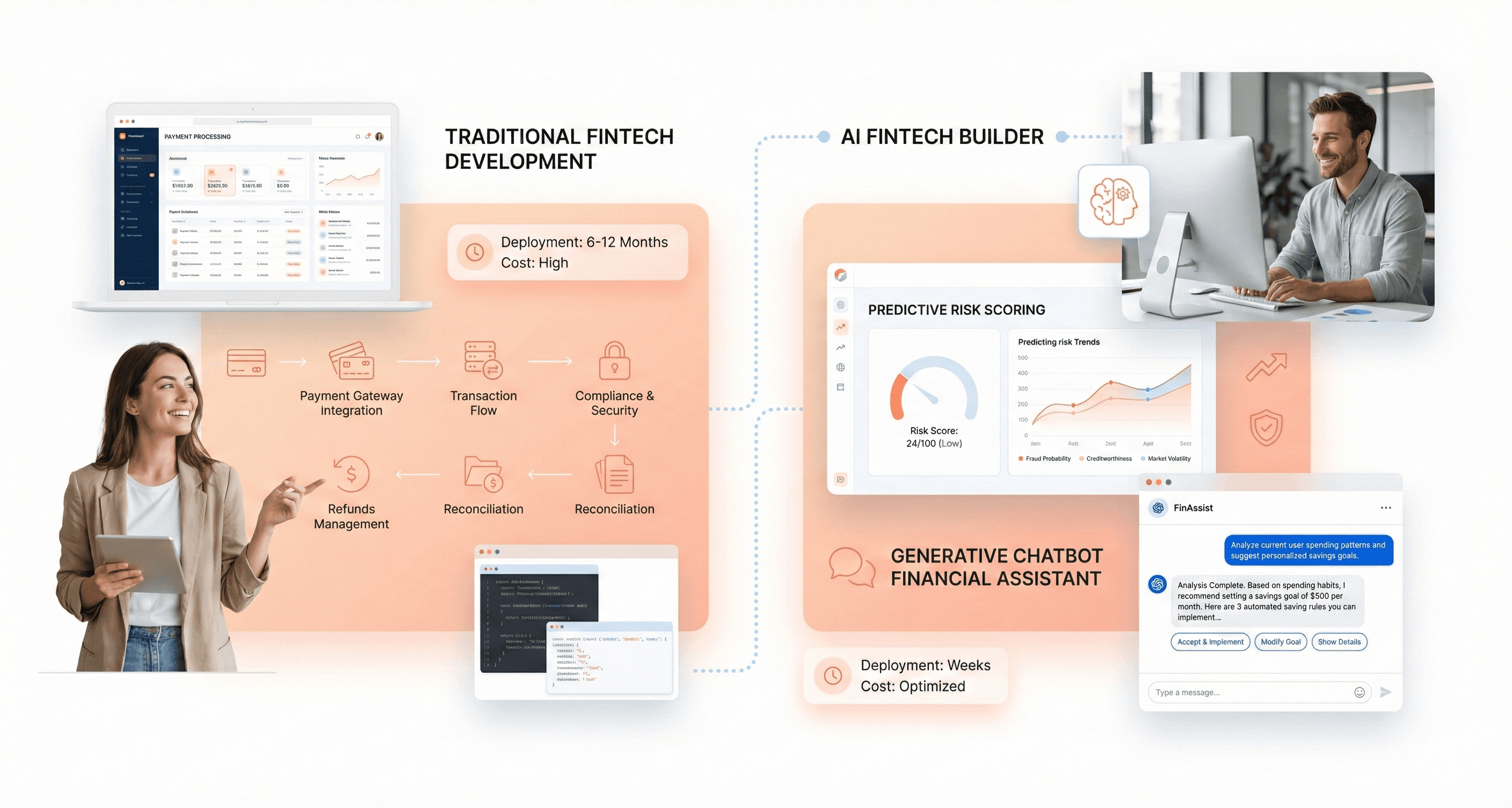

Traditional Fintech Development vs AI Fintech Builders

Core differences between predictive AI and generative AI in financial applications

Artificial intelligence in finance operates through two primary paradigms that serve distinct purposes in fintech development services. Predictive AI focuses on analyzing historical and real-time data to forecast future financial outcomes, market trends, and risk assessments. This technology excels in credit scoring, fraud detection, and investment portfolio optimization by leveraging machine learning algorithms to identify patterns and predict probabilities.

Generative AI, conversely, creates new content and solutions by understanding existing data patterns and generating novel outputs. In financial services, this manifests as automated report generation, personalized financial advice, and intelligent chatbots that can provide sophisticated customer support. The fundamental distinction lies in their approach: predictive AI interprets data to make forecasts, while generative AI uses data understanding to create new financial solutions and content.

When to choose conventional fintech development over AI-enhanced solutions

Traditional fintech app development remains the optimal choice when dealing with straightforward financial operations that don't require complex pattern recognition or predictive capabilities. Simple payment processing, basic account management, and standard transaction recording typically benefit more from conventional development approaches due to their reliability and lower complexity.

AI-powered financial services become necessary when your fintech startup development requires advanced data analysis, real-time risk assessment, or personalized user experiences. The decision hinges on whether your application needs to process vast amounts of data to make intelligent decisions or simply execute predefined financial transactions efficiently.

Cost implications and resource requirements for each approach

AI fintech builders face significantly higher upfront investment requirements compared to traditional fintech development services. AI-powered solutions demand substantial computing resources, specialized talent, and extensive data infrastructure to train and maintain machine learning models effectively. The workforce skill gap in AI expertise often necessitates external partnerships with specialists, adding to overall project costs.

Conventional fintech development typically requires lower initial investment but may lack the scalability and intelligent automation that AI solutions provide. The total cost of ownership varies significantly based on your specific use case and long-term growth projections. AI implementation in banking and financial services often delivers higher ROI over time through automation and improved decision-making capabilities, despite the elevated initial investment in fintech technology stack and specialized development resources.

Key AI Technologies Transforming Financial Services

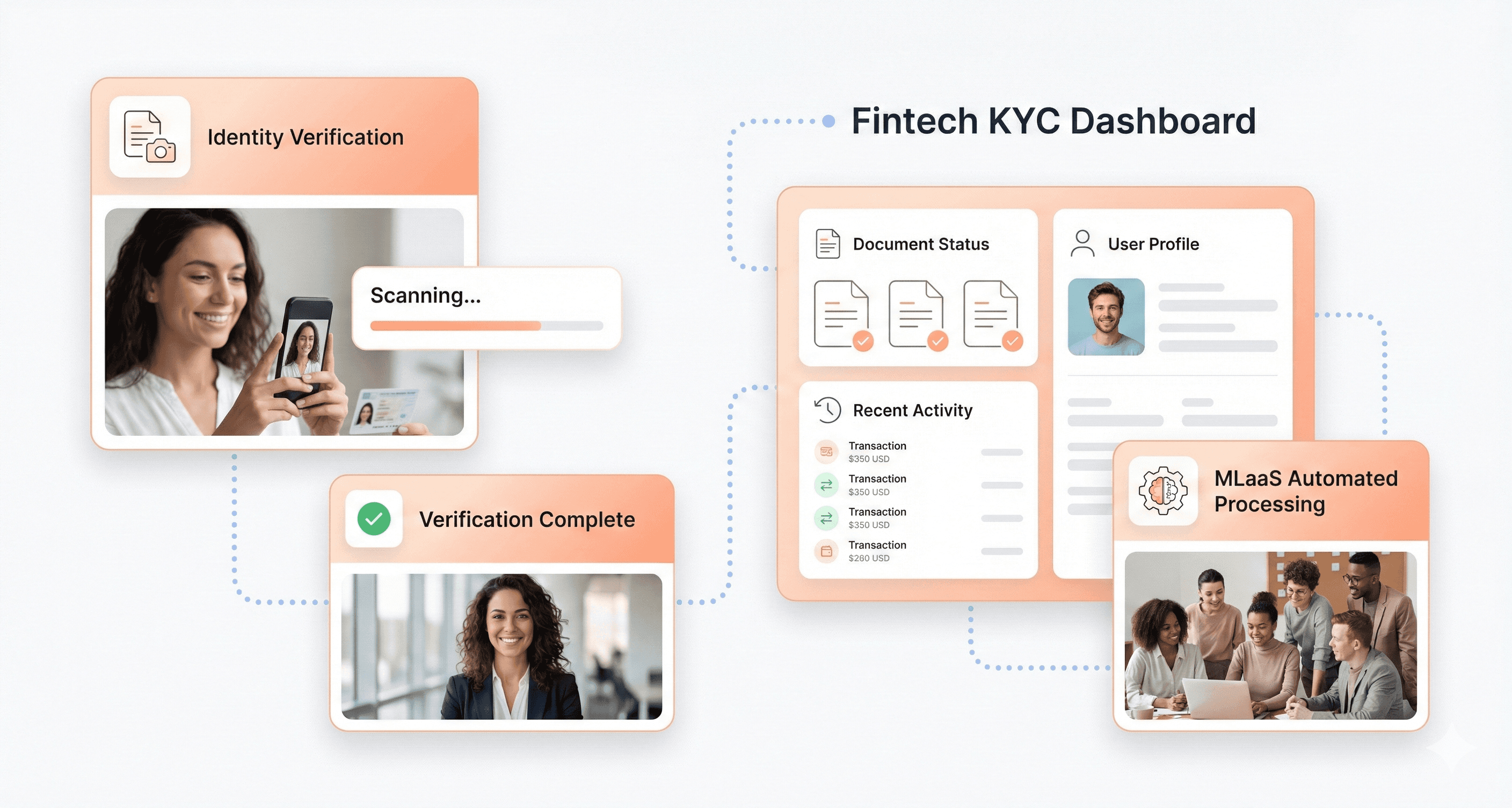

Machine Learning as a Service (MLaaS) and its accessibility advantages

Machine Learning as a Service (MLaaS) has emerged as a transformative approach for fintech companies looking to integrate AI capabilities without the complexity of building infrastructure from scratch. This cloud-based delivery model provides pre-built ML algorithms and frameworks that financial institutions can leverage to enhance their operations efficiently.

MLaaS platforms offer significant accessibility advantages that make machine learning adoption more feasible for fintech organizations of all sizes. Unlike traditional ML implementations that require extensive technical expertise and infrastructure investment, MLaaS solutions democratize access to sophisticated algorithms. Financial institutions can now tap into powerful ML capabilities without maintaining large data science teams or investing heavily in specialized hardware.

The automation capabilities of MLaaS are particularly valuable in fintech applications. These services can streamline customer onboarding processes by validating client information in real-time without manual input, while also automating the reconciliation of financial transactions. This eliminates the need for manual data entry, saving both time and resources while reducing the risk of human error.

Resource allocation becomes more efficient through MLaaS platforms, as they enable fintech companies to scale their AI capabilities on demand. Organizations can access advanced algorithms for tasks ranging from optical character recognition (OCR) to automated document processing systems, supporting critical processes like loan application processing and Know Your Customer (KYC) checks without significant upfront investment.

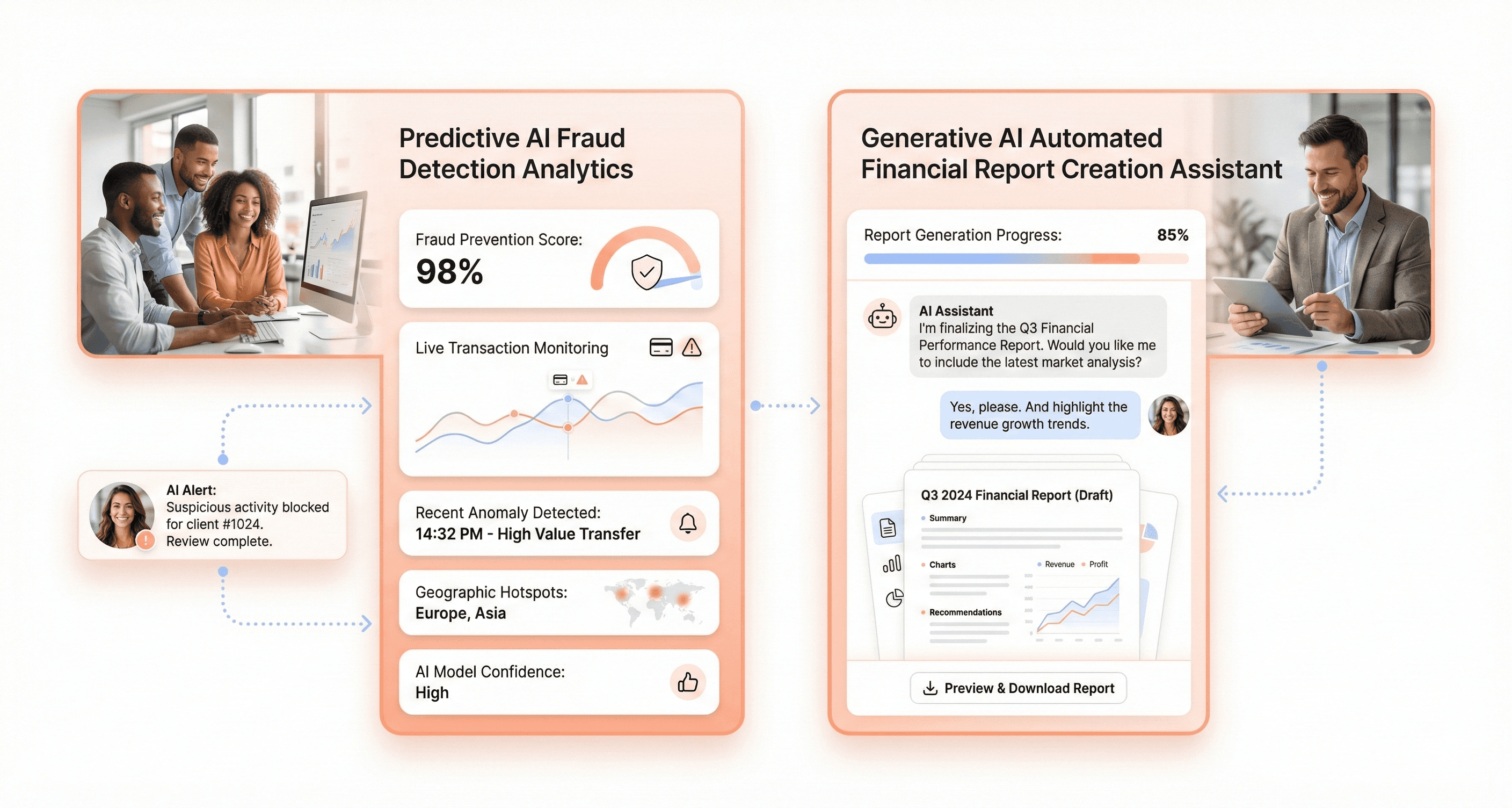

Predictive AI applications in fraud detection and risk assessment

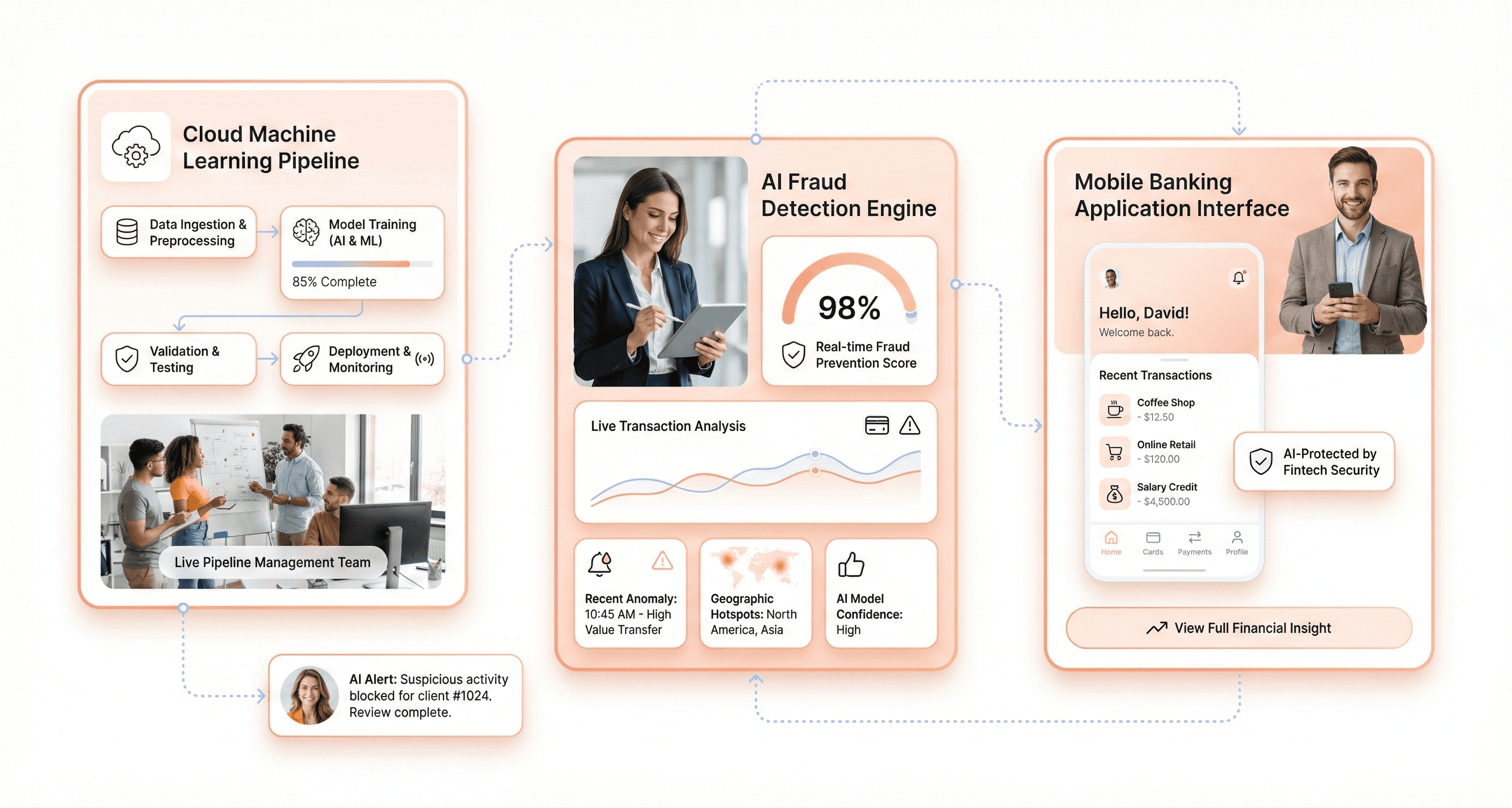

Predictive AI has revolutionized fraud detection and risk assessment in financial services, moving beyond static rule-based systems to dynamic, learning-enabled protection mechanisms. These AI-powered systems continuously learn and adapt to new fraud patterns, ensuring better protection for financial operations and customers.

In fraud detection, machine learning algorithms excel at identifying complex fraud patterns through the analysis of vast datasets. Unlike conventional approaches, these systems can simultaneously detect multiple types of fraud, including payment fraud, credit card fraud, identity theft, and account takeovers, providing comprehensive protection against various threats. The real-time operability of these systems is particularly impressive, with ML enabling fraud detection in up to 100% of transactions, allowing financial institutions to respond swiftly to potential threats and minimize financial losses.

The accuracy of ML-driven fraud detection significantly reduces false positives, relieving the burden on fraud analysts and streamlining their workload. This allows security teams to focus their efforts on the most relevant alerts, improving overall operational efficiency while maintaining robust security standards.

For risk assessment, predictive AI transforms traditional approaches by processing vast amounts of data in real-time, proactively identifying subtle patterns and correlations that human analysts might miss. ML models analyze historical market data to forecast trends, enabling financial institutions to make informed investment decisions and better manage market risks. These systems excel at operational risk mitigation, identifying anomalies in operational and transaction data to detect and prevent fraud, cyber threats, and operational failures.

Client segmentation capabilities allow financial institutions to cluster customers based on their risk profiles, enabling tailored risk management strategies for specific client segments and optimizing resource allocation. Additionally, ML models can identify the most effective approaches to recover overdue payments while minimizing customer churn and overall losses.

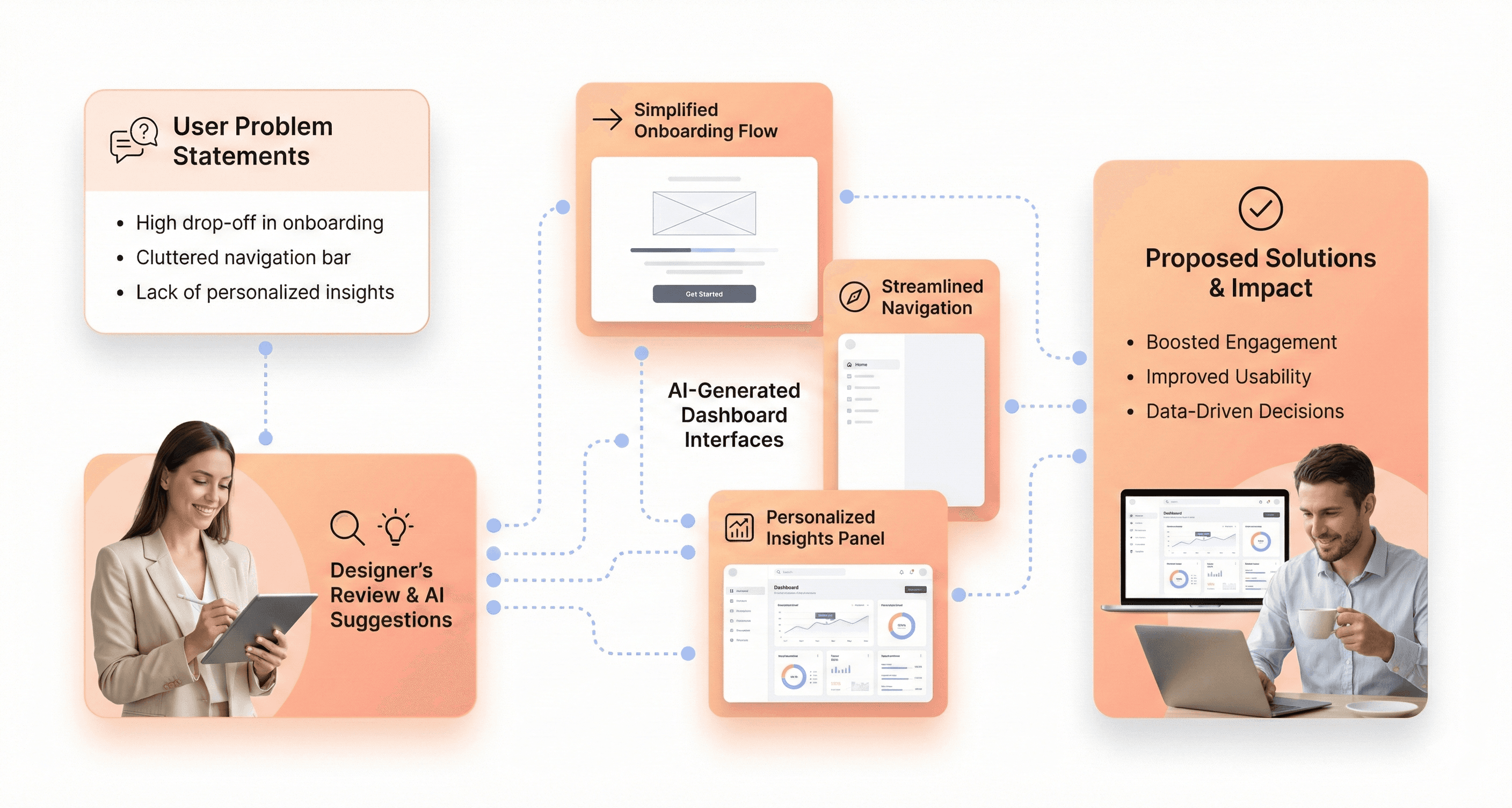

Generative AI capabilities for customer-facing experiences and research tools

Generative AI (GenAI) represents the next evolution in customer-facing fintech experiences and research capabilities, building upon the foundation of machine learning to create more natural, contextually relevant interactions. These advanced AI systems can generate instant, personalized responses to customer queries while providing sophisticated analytical tools for financial research.

In customer service applications, GenAI-powered chatbots and virtual assistants offer round-the-clock support with significantly improved natural language processing capabilities. These systems can handle a high volume of inquiries efficiently, ensuring no request goes unanswered while providing rapid responses that enhance overall customer satisfaction. The conversational AI can understand and respond to customer inquiries more accurately and contextually than traditional script-based systems, creating more engaging user experiences through AI-driven financial interface design.

GenAI excels in creating hyper-personalized banking experiences by synthesizing appropriate, automated responses from vast customer interaction datasets. These systems can generate custom reports and insights that automatically summarize complex financial data in personalized formats, making sophisticated financial information more accessible to individual customers.

For research and analytical applications, GenAI can assist in creating predictive models and refining investment strategies by analyzing real-time news feeds, social sentiment information, and historical trading data. This capability enables financial institutions to generate regulatory documents and reports with AI assistance, ensuring they efficiently adapt to changing regulations while maintaining compliance standards.

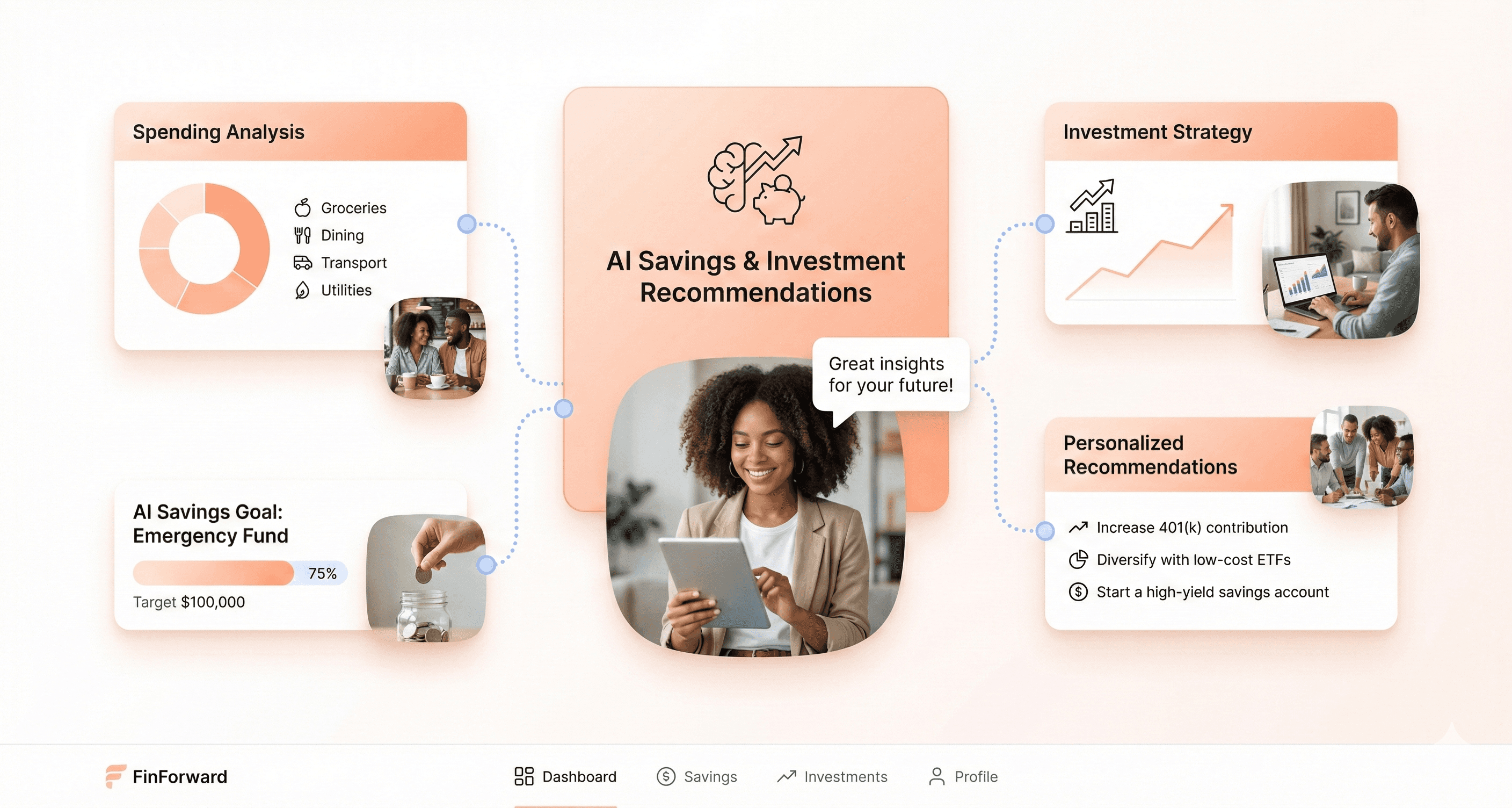

The technology also supports robo-advisors in providing more sophisticated portfolio management by generating personalized financial recommendations based on customer profiles and preferences. This allows users to receive tailored suggestions about savings, investments, and insurance solutions while maintaining the cost-effectiveness of automated advisory services.

AI Implementation Framework for Fintech Startups

Identifying optimal use cases for predictive vs generative AI

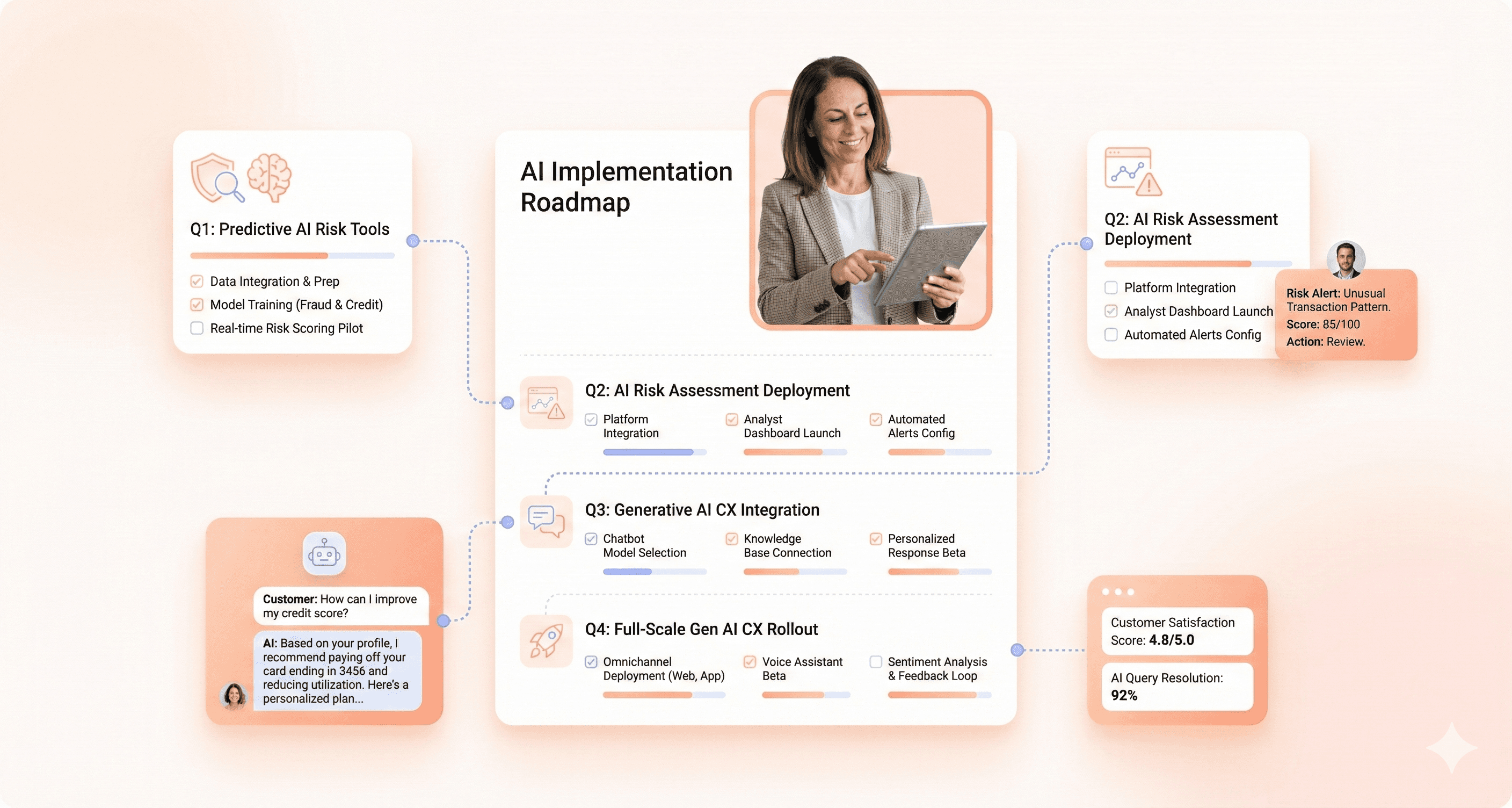

When implementing AI fintech solutions, understanding the distinct capabilities of predictive and generative AI becomes crucial for strategic success. Predictive AI excels at analyzing vast amounts of transaction data to identify patterns and anomalies, making it ideal for fraud detection, risk assessment, and credit scoring applications. Machine learning algorithms can process thousands of data points to determine creditworthiness more accurately than traditional methods, as demonstrated by platforms like Upstart that analyze non-traditional data points for loan assessments.

For fraud prevention, predictive AI systems like Mastercard's Decision Intelligence analyze real-time transactions, providing more accurate fraud scores while reducing false declines. This approach saves money by preventing fraud while simultaneously improving customer experience through fewer legitimate transaction rejections.

Generative AI, conversely, creates new content based on patterns learned from existing data, making it perfect for personalized financial content creation and customer engagement. In wealth management, generative AI produces customized investment reports tailored to individual client financial situations, goals, and risk tolerance. For marketing applications, it creates personalized content at scale, enabling fintech companies to deliver relevant messaging to diverse customer segments.

The key distinction lies in application: use predictive AI for data analysis, risk management, and pattern recognition tasks, while deploying generative AI for content creation, personalization, and customer communication enhancement.

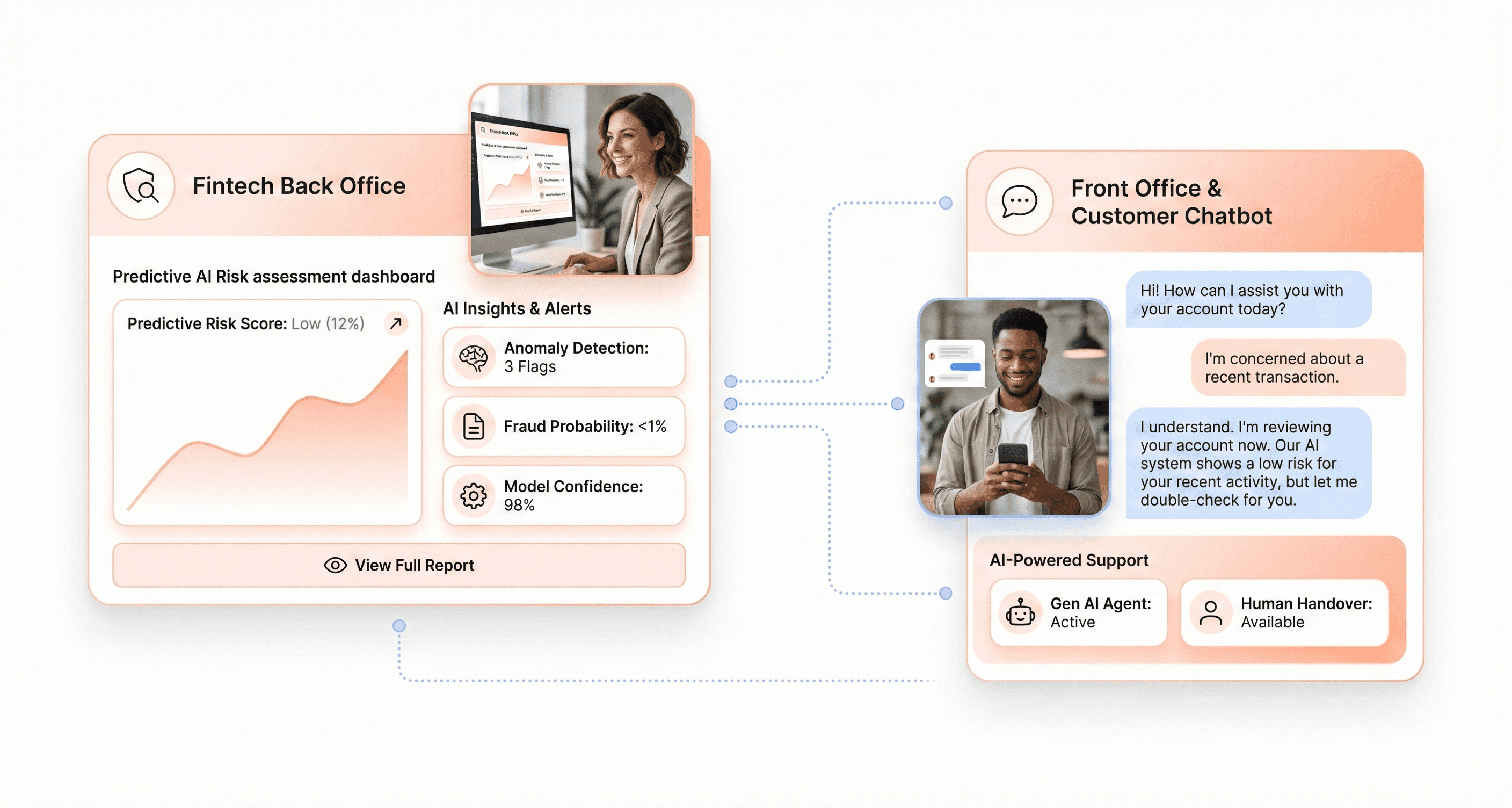

Combining back-office predictive AI with front-office generative AI experiences

Now that we understand the distinct use cases, successful fintech AI implementation requires strategic integration of both technologies across different operational areas. Back-office predictive AI systems should handle risk management, compliance monitoring, and fraud detection processes that require pattern recognition and anomaly identification capabilities.

Machine learning models can continuously analyze financial data, transaction patterns, and borrower behavior, adapting in real-time to emerging threats. This back-office intelligence enables faster execution, fewer errors, and more resilient operations while maintaining the security and compliance standards essential for financial services.

Front-office applications benefit significantly from generative AI integration, particularly for customer-facing services by scalable fintech design systems. Natural Language Processing (NLP) technologies enable AI-driven financial assistants like Cleo to engage users through conversational interfaces, providing personalized financial insights and advice. These systems help users track spending, save money, and achieve financial goals through intuitive, human-like interactions.

Virtual assistants and AI-powered chatbots handle routine customer queries instantly, cutting wait times and improving service quality. Bank of America's Erica exemplifies this approach, having processed over 800 million customer inquiries while delivering 1.2 billion financial insights, demonstrating how front-office generative AI can significantly streamline operations while enhancing customer satisfaction.

Data security considerations and compliance requirements for AI integration

With this strategic framework in mind, data privacy and security emerge as paramount concerns when implementing AI fintech solutions. AI-powered systems must safeguard customer data while ensuring compliance with complex regulatory requirements that govern financial services.

Financial institutions must implement robust data governance frameworks to address legacy infrastructure challenges that aren't designed for AI integration. Organizations should prioritize API-enabled, cloud-based platforms that connect seamlessly with existing systems while maintaining security standards. Starting with focused AI projects using well-structured data helps build momentum while minimizing risk exposure.

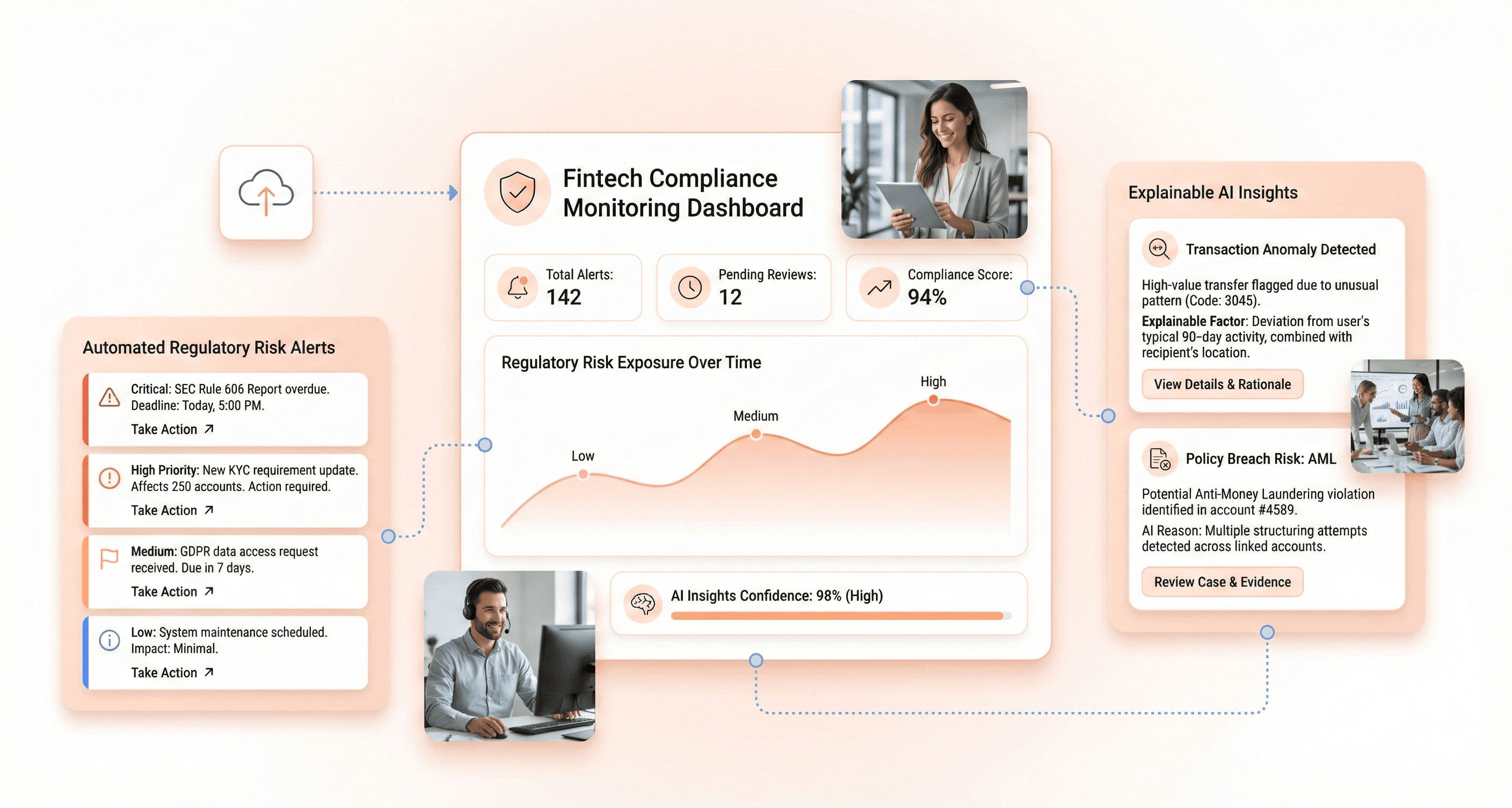

Explainable AI (XAI) becomes essential for regulatory compliance, as regulators increasingly demand transparency in AI decision-making processes. Solutions like Ayasdi enhance anti-money laundering and banking compliance by using machine learning to detect patterns and anomalies while providing the transparency required for regulatory oversight.

Data protection requires continuous monitoring capabilities where AI systems detect and prevent cyber threats, reducing data breach risks and financial losses. Real-time data governance and monitoring enable financial institutions to maintain high standards of data integrity while ensuring customer information is handled responsibly.

Organizations must establish regular audit processes to identify potential biases or compliance issues, engage proactively with regulators to understand upcoming requirements, and document all AI processes thoroughly to demonstrate compliance. This comprehensive approach ensures that AI implementation enhances security and compliance rather than creating additional regulatory risks.

Building Competitive Moats Using AI Fintech Builders

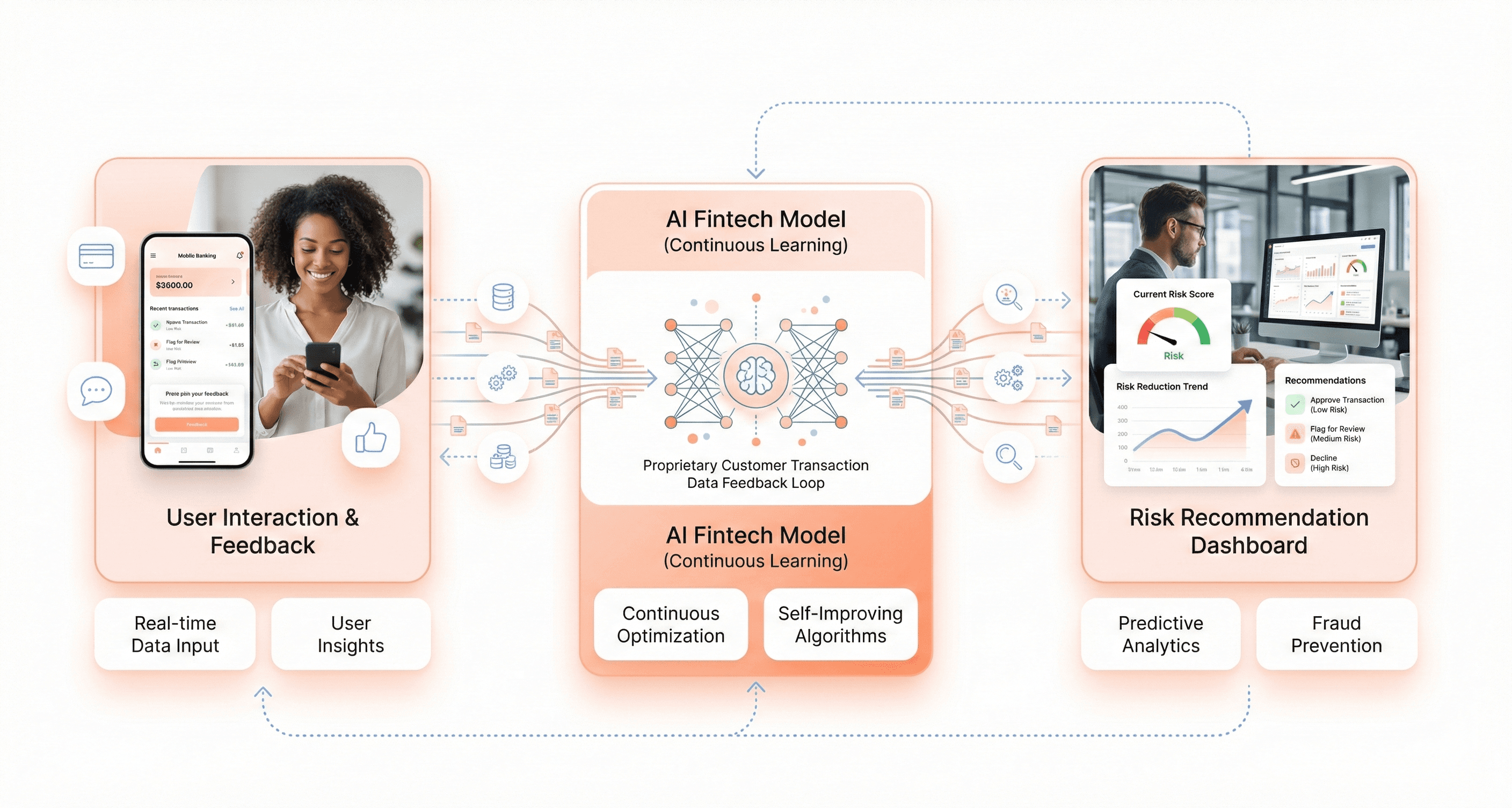

Leveraging Proprietary Data to Differentiate AI Models

The foundation of any competitive advantage in AI-powered fintech lies in the quality and uniqueness of data used to train models. Traditional fintech development services often rely on standardized datasets, but AI fintech builders must focus on cultivating proprietary data sources that create irreplaceable value. This approach transforms raw financial information into intelligent insights that competitors cannot easily replicate.

Financial institutions and fintech startups that implement AI solutions gain significant advantages when they can access unique transaction patterns, user behavior data, and market-specific information. These proprietary datasets enable machine learning fintech applications to develop more accurate risk assessment models, personalized financial recommendations, and fraud detection systems that outperform generic solutions.

The key to building defensible AI models lies in creating feedback loops where user interactions continuously improve algorithm performance. As fintech AI solutions process more transactions and user decisions, they become increasingly sophisticated and tailored to specific market segments. This creates a compounding effect where better data leads to improved AI performance, which attracts more users and generates even richer datasets.

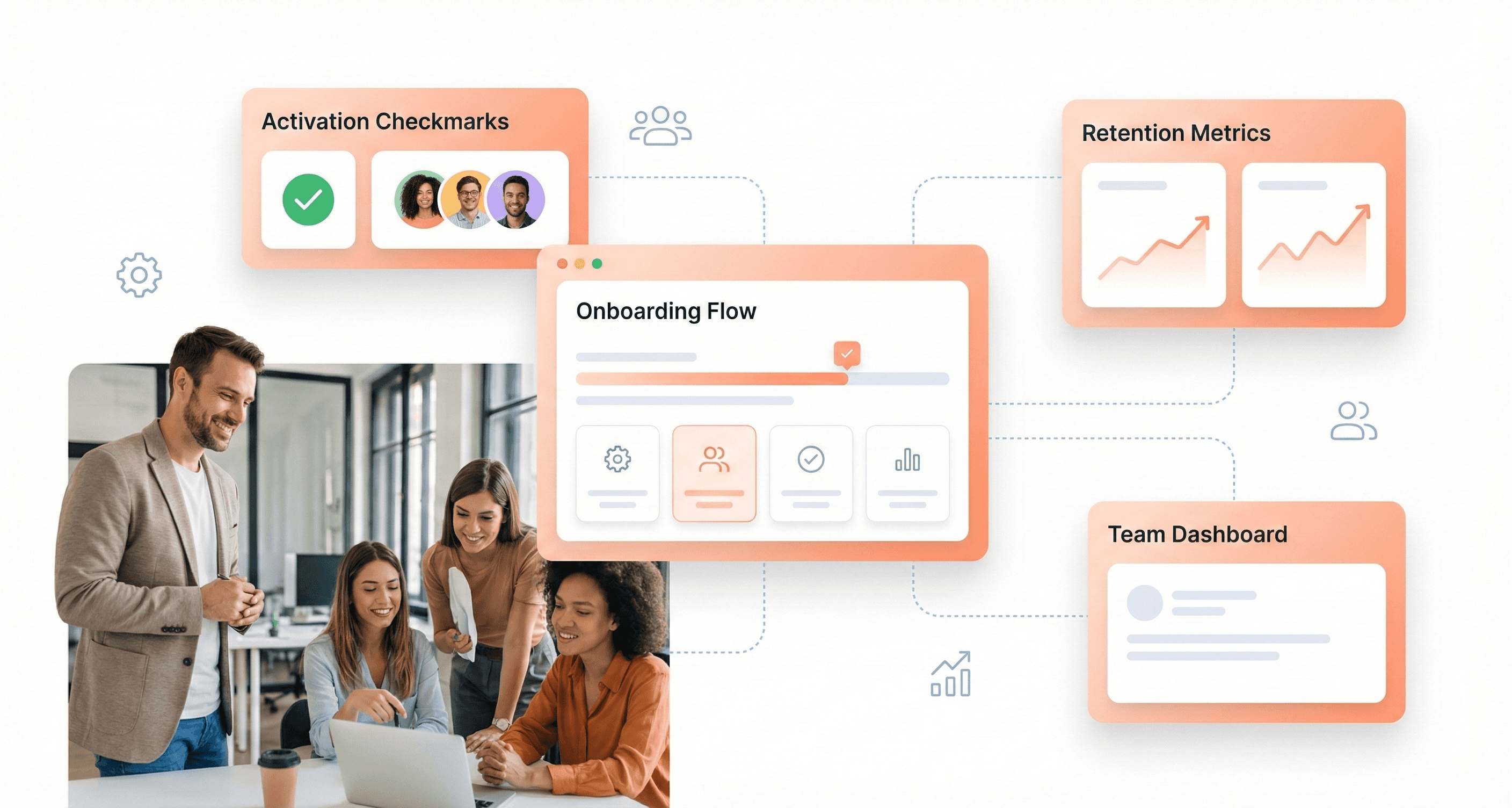

User Acquisition Strategies That Benefit from AI System Improvements

Now that we understand the importance of proprietary data, it's crucial to examine how AI-powered financial services can create viral growth loops through intelligent user acquisition. Unlike traditional fintech app development approaches that rely solely on marketing spend, AI fintech builders can design acquisition strategies that improve as the underlying systems learn and adapt.

Intelligent fintech platforms leverage AI to optimize user onboarding experiences in real-time, adjusting recommendations and interface elements based on user behavior patterns. This personalization increases conversion rates and user satisfaction, leading to higher organic referral rates. As more users join the platform, the AI systems gain access to more diverse behavioral data, enabling even better personalization for future users.

AI implementation in banking and fintech services also enables predictive user acquisition, where machine learning algorithms identify high-value prospects before competitors do. By analyzing transaction patterns, financial goals, and engagement behaviors, AI-powered systems can predict which users are most likely to benefit from specific financial products, creating more efficient and cost-effective acquisition campaigns.

Creating Defensible Technology Infrastructure and Moderation Processes

With user acquisition strategies in place, the next critical component involves building technology infrastructure that becomes more valuable and harder to replicate over time. Automated financial services require robust, scalable systems that can handle increasing data volumes while maintaining security and compliance standards.

AI fintech frameworks must incorporate multiple layers of intelligent moderation and risk management processes. These systems need to continuously monitor transactions, user behavior, and market conditions to identify potential threats or regulatory compliance issues. The defensive value comes from the accumulated knowledge these systems gain over months and years of operation.

The fintech technology stack for AI-powered solutions requires specialized infrastructure components that traditional development approaches don't typically include. These include real-time data processing pipelines, model versioning systems, and automated testing frameworks that ensure AI models maintain performance as they evolve. The complexity and integration of these systems create significant barriers to entry for potential competitors.

Fintech innovation services that focus on AI implementation must also consider data privacy and security as core competitive advantages. By building privacy-preserving machine learning capabilities and implementing advanced encryption methods, AI fintech builders create trust moats that are difficult for competitors to breach. This technical sophistication becomes a key differentiator in markets where user trust and regulatory compliance are paramount.

Practical Development Considerations for AI Fintech Apps

Essential Technical Stack Requirements and Security Implementations

Building AI-powered fintech applications requires a robust technical foundation that addresses both computational demands and stringent security requirements. The core technology stack must incorporate machine learning frameworks, blockchain capabilities, and mobile application infrastructure to support the diverse needs of modern financial services.

AI fintech builders need specialized infrastructure to handle large datasets effectively. Machine learning algorithms require substantial computational resources to analyze transaction patterns, perform fraud detection, and deliver personalized financial recommendations. The technology stack should include cloud-based solutions that can scale dynamically based on processing demands and data volume requirements enabled by AI-powered SaaS UI modernization.

Security implementations form the cornerstone of any fintech technology stack, particularly when dealing with sensitive financial data. AI-powered fraud detection systems must operate within secure environments that protect customer information while enabling real-time analysis of transaction patterns. These systems require automated security monitoring capabilities that can identify potential breaches and regulatory compliance violations before they impact operations.

Data privacy considerations become even more critical in AI fintech development, as machine learning models require extensive training datasets containing sensitive financial information. Security protocols must ensure that customer data remains protected throughout the AI training process while maintaining the data quality necessary for accurate model performance.

Development Cost Factors and Budget Optimization Strategies

AI fintech app development involves several cost considerations that differ significantly from traditional fintech development services. The primary cost drivers include specialized AI talent, computational infrastructure, data management systems, and ongoing model maintenance requirements.

Infrastructure costs represent a substantial portion of AI fintech development budgets. Machine learning algorithms require significant computational power for training and inference, leading to higher cloud computing expenses compared to conventional applications. However, these costs can be optimized through strategic resource allocation and efficient model design that balances accuracy with computational efficiency.

Data quality dependency directly impacts development costs, as AI models require clean, accurate, and comprehensive datasets to function effectively. Poor-quality data can lead to increased development time, additional data cleaning expenses, and potential model retraining costs. Budget optimization strategies should include robust data validation processes and quality assurance measures from the project's inception.

Regulatory compliance challenges add another layer to development costs, as AI systems must be designed to meet current financial regulations while remaining adaptable to future compliance requirements. This necessitates additional development time for compliance integration and ongoing monitoring systems.

Skills and Expertise Needed for Successful AI Fintech Development

Successful AI fintech development requires a multidisciplinary team combining traditional fintech expertise with specialized artificial intelligence capabilities. The development team must understand both financial services requirements and the technical complexities of implementing machine learning solutions in regulated environments.

Core technical expertise includes proficiency in machine learning algorithms, data science methodologies, and AI model deployment strategies. Team members should possess deep knowledge of fraud detection systems, credit scoring models, and automated financial advisory algorithms. This technical foundation enables the creation of AI-powered solutions that can identify transaction anomalies, assess creditworthiness using diverse data sources, and provide personalized investment recommendations.

Financial domain expertise remains equally important, as AI implementations must align with banking regulations, compliance requirements, and industry best practices. The development team should understand regulatory reporting needs, risk management principles, and customer service standards specific to financial services.

Ethical AI considerations require specialized knowledge to address bias in machine learning models and ensure fair outcomes across diverse customer populations. This expertise helps prevent discriminatory practices and maintains the trust necessary for successful fintech operations. Teams must also understand the implications of using customer data for AI training while maintaining privacy and security standards.

Market Opportunities and Current Limitations

High-growth segments in AI-driven investing research and vertical SaaS

The global artificial intelligence in fintech market presents remarkable growth opportunities, with the market size projected to reach USD 41.16 billion by 2030, growing at a compound annual growth rate (CAGR) of 16.5% from 2022 to 2030. This expansion from USD 9.45 billion in 2021 demonstrates the massive potential for AI fintech builders and fintech development services.

Business analytics and reporting emerged as the leading application segment in 2021, accounting for over 32% of global revenue. This dominance reflects the critical need for AI-powered financial services to provide regulatory compliance management and customer behavior analysis. Fintech app development in this space focuses on creating solutions that increase operational efficiency, enable more informed decision-making, and ultimately drive revenue growth.

Algorithmic trading and portfolio management represent another high-growth vertical, with AI applications providing valuable insights and forecasting changes in market trends, exchange rates, and investments. These AI fintech frameworks utilize data analytics that account for news, current financial market states, social media sentiments, economic indicators, and historic financial data. Major institutions like HSBC are already using AI to boost predictive analytics for identifying potential high-growth stocks.

The quantitative and asset management segment continues to expand as AI-powered robo-advisors deliver risk-versus-return calculations and personalized financial advice. These intelligent fintech platforms can be customized to individual risk profiles based on past investment decisions and financial goals, offering actionable insights for investment strategies.

Untapped potential in taxes, personal finance, and compliance automation

While established segments show strong growth, significant untapped opportunities exist in emerging areas of AI implementation in banking and personal financial services. Personal finance management represents a particularly promising vertical, where AI-based tools can analyze spending habits, investment preferences, and interaction patterns to create highly personalized offerings.

AI-powered personal finance tools and services can act as comprehensive robo-advisors, helping consumers create smarter budgets based on their specific needs, maintain financial records, track personal spending, bills, assets and liabilities, and suggest saving strategies. These automated financial services provide more accessible and affordable alternatives to traditional human advisors.

Tax preparation and compliance automation present substantial opportunities for fintech startup development. AI can streamline tax-related processes by analyzing income, transactions, and deductions while ensuring compliance with ever-changing regulations. The technology's ability to process vast amounts of data quickly makes it ideal for handling complex tax scenarios and reducing human error.

Regulatory compliance management across various financial sectors remains largely underutilized. AI systems can help financial institutions navigate complex regulatory frameworks by automatically monitoring transactions for compliance violations, generating required reports, and ensuring adherence to federal policies. This is particularly valuable as regulatory frameworks struggle to keep pace with technological change.

Overcoming accuracy concerns and fragile language model challenges

Despite the promising opportunities, AI fintech builders face significant challenges that must be addressed for successful implementation. According to a 2024 US Department of Treasury report, "Generative AI models are still developing, currently very costly to implement and very difficult to validate for high-assurance applications."

Data privacy and protection continue to be primary concerns for fintech technology stack development. Financial institutions must ensure robust data governance and transparency so human managers can understand how AI systems arrive at decisions or solutions. The highly regulated nature of the financial sector means any innovations in AI-powered financial services must adhere to strict regulatory compliance requirements.

Algorithmic bias presents another critical challenge that fintech development services must address. AI models can perpetuate or amplify existing biases in financial data, potentially leading to unfair lending practices or discriminatory service delivery. Implementing proper bias detection and mitigation strategies is essential for building trustworthy AI fintech solutions.

Infrastructure and expertise gaps create additional barriers to adoption. Most financial organizations lack appropriate tech infrastructure or finance professionals with sufficient technical expertise, leading to reliance on third-party IT infrastructure and data. This dependency exposes institutions to financial, legal, and security risks that must be carefully managed.

Model validation and reliability remain significant hurdles, particularly for high-assurance applications in banking and lending. The challenge lies in developing AI systems that can demonstrate consistent accuracy and reliability while maintaining explainability for regulatory purposes. As a result, most financial firms have opted for enterprise solutions rather than public generative AI providers to maintain control and security.

Conclusion

The fintech landscape is rapidly evolving as founders navigate the choice between traditional development services and AI-powered solutions. While predictive AI excels at fraud detection, risk modeling, and compliance tasks, generative AI shines in customer-facing experiences through chatbots and personalized financial advice. The most successful fintech companies are combining both technologies—using predictive AI for back-office workflows and generative AI for front-office customer interactions. Machine Learning as a Service (MLaaS) platforms have democratized access to these capabilities, allowing companies to integrate sophisticated AI features without building models from scratch.

Building a competitive moat in AI-powered fintech requires strategic thinking about data sources, model parameters, and user experience design. Companies that layer proprietary customer data into their models and race to acquire users will likely emerge as winners in each category. However, founders must carefully consider accuracy requirements, data security concerns, and the substantial investment needed in data science infrastructure. The key lies in understanding when to apply conventional ML versus generative AI—choosing rigor and precision for zero-mistake environments while leveraging conversational AI for more forgiving consumer-facing applications. Success demands deep domain expertise, strong technical capabilities, and the agility to adapt as AI technologies continue reshaping financial services.

About the author

Author Name:

Parth G

|

Founder of

Hashbyt

I’m the founder of Hashbyt, an AI-first frontend and UI/UX SaaS partner helping 200+ SaaS companies scale faster through intelligent, growth-driven design. My work focuses on building modern frontend systems, design frameworks, and product modernization strategies that boost revenue, improve user adoption, and help SaaS founders turn their UI into a true growth engine.